Cryptocurrency scams targeting younger victims – primarily in the 25-34 age group – have risen by 23% in 2023, per an urgent warning issued by Lloyds Banking Group (LON: LLOY) in November 2023. The amount lost by the victims has similarly risen to £10,741 – $13,300 at the time of writing – from £7,010 ($8,750) in 2022.

The scammers recruit their victims on social media platforms like Meta’s (NASDAQ: META) Facebook and Instagram in approximately 66% of the cases, according to the Lloyds report, and most transactions are conducted using the fast payments provider Revolut. The warning, however, specifies that Revolut is usually not the final destination for the stolen funds.

The bank further reports victims usually make three payments – over the course of 100 days on average – to scammers before realizing they have been tricked, Additionally, most of the scams take the form of various fake investment schemes.

How do crypto investment scams work?

Crypto investment scams have taken the top spot when it comes to popularity, having overtaken other common forms like romance and purchase scams. They usually involve a fake investment account for a non-existent company, with the fraudster posing as an investment manager of some variety.

Lloyds, however, also warns that scammers sometimes actually set up and register firms to enhance the illusion that their offers are legitimate. They also sometimes initially set up investment accounts under the victim’s control only to trick them into handing over the credentials at a later date.

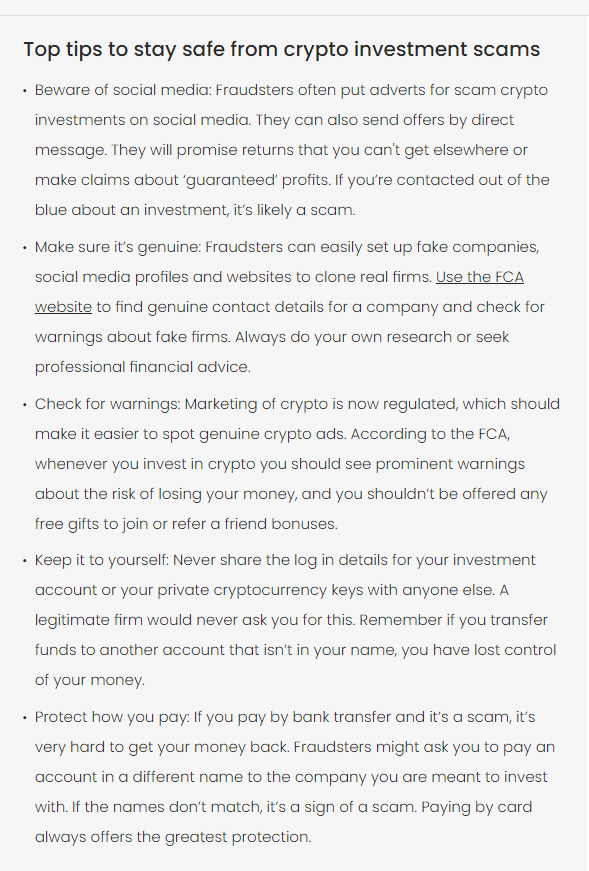

Despite the decisive shift toward investment scams, the warning also highlights that other common types, like pig butchering, remain popular and continue using cryptocurrencies’ pseudo anonymity when requesting money from their victims. Lloyds also included a short guide on how to protect yourself from crypto scams in its warning notice.

Crypto phishing scams on the rise

Interestingly, Lloyds’ report mentioned the use of fake celebrity endorsements created using deepfake technology in promotional material for fraudulent crypto investment opportunities.

Indeed, there has recently been an uptick in phishing attempts using such techniques, with a recent notable example having a digitally made Brad Garlinghouse – the CEO of Ripple Labs – telling viewers on YouTube to send their XRP to a specific address.

Deepfakes aren’t the only way scammers are trying to phish crypto out of their victims. Some are sending fake OpenSea emails claiming to contain NFT offers, according to a November 14 X post by the well-known crypto reporter Colin Wu.

Another type of crypto phishing scam recently discovered involves scammers posing as journalists seeking to convince their victims to allow malicious JavaScript code to wreak havoc on their devices.

Link del artículo original

Si el presente artículo, video o foto intrigue cualquier derecho de autor por favor señálelo al correo del autor o en la caja de comentarios.